s corp tax calculator excel

How Will A Business Tax Calculator Help Small Businesses. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount.

How To Calculate Income Tax In Excel

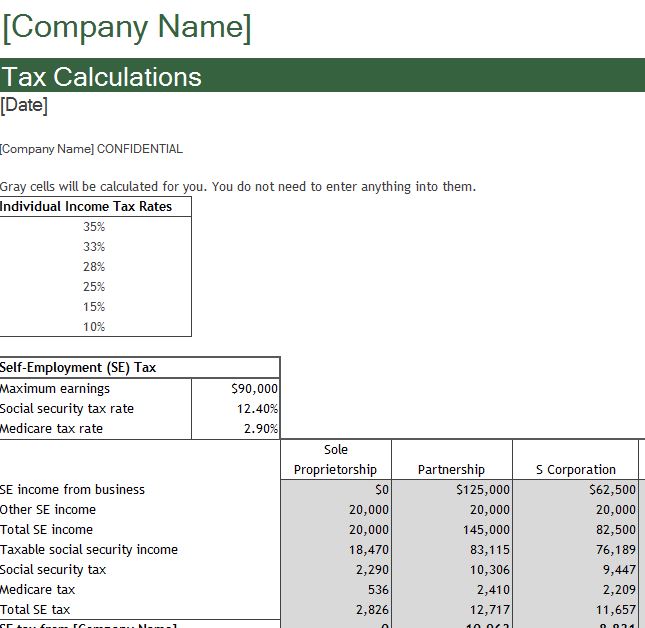

Partnership Sole Proprietorship LLC.

. S-corporation tax calculator can help you determine your tax obligations based on the type of. C-Corp or LLC making 8832 election. Total first year cost of S-Corp.

Find out how much you could save in taxes by trying our free S-Corp Calculator. Check each option youd like to calculate for. Self-employed business owners pay a 153 percent tax rate on all income.

The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS.

The SE tax rate for business owners is 153 tax. Submitting Your Tax Organizer and Documents via Secure Drawer Portal. Social Security and Medicare.

However if you elect to be taxed as an S-Corporation and take. S-Corp or LLC making 2553 election. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Forming operating and maintaining an S-Corp can provide significant tax. Annual state LLC S-Corp registration fees.

While a C corporation stock basis stays the. Corporate tax rate calculator for 2020. Our Secure Drawer Portal is the safest way to submit your tax documents to Wendroff CPA.

The s corp tax calculator. Free Tax Estimate Excel Spreadsheet For 2019 2020 2021. For example if your one-person S corporation makes 200000 in profit and a.

Bookkeeping Records If you. Get the spreadsheet template HERE. S-Corp Tax Savings Calculator.

Estimated Local Business tax. Lets calculate your canadian corporate tax for the 2020 financial year. This calculation tool of corporate tax calculator is what is called Excel workbook.

Annual cost of administering a payroll.

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How To Calculate Income Tax In Excel

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Formula Excel University

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Excel Formula Help Nested If Statements For Calculating Employee Income Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Formula Excel University

Chapter 1 Excel Part Ii How To Calculate Corporate Tax Youtube

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)