are assisted living facility fees tax deductible

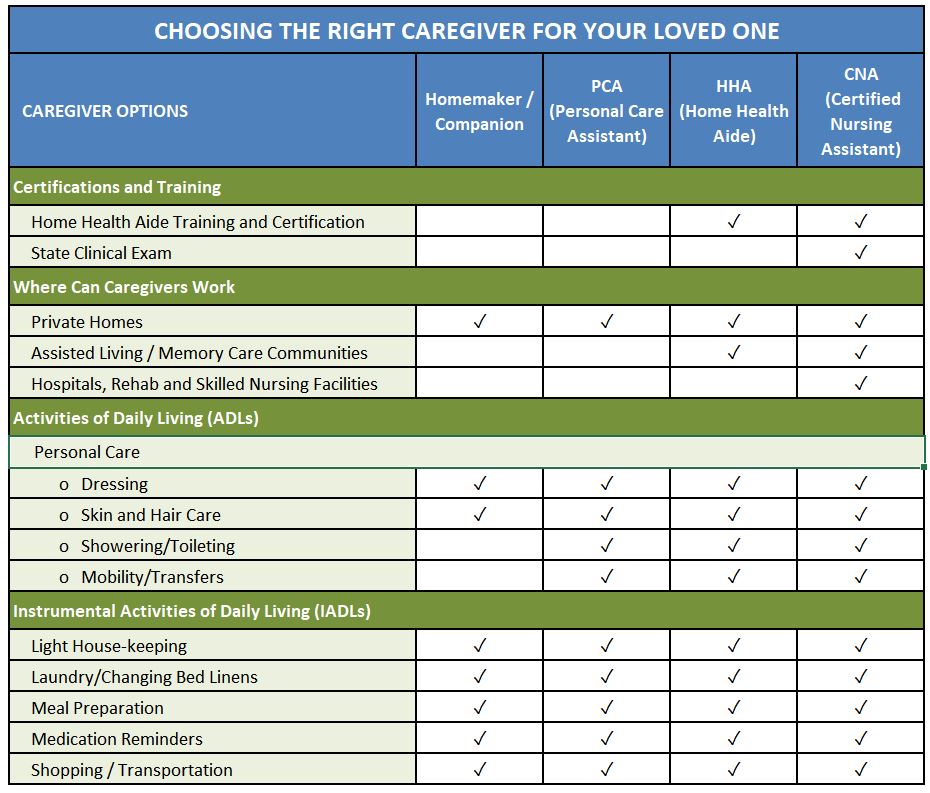

Assisted living costs vary based on the facility location amenities size of apartment and level of care needed. Assisted living facilities also offer nutritious meals housekeeping and social activities in a senior-friendly environment.

In 1987 a Capital Campaign was launched with the goal of establishing the first centralized animal shelter in Wayne County.

. Is about 4000 according to Genworth. However the median monthly cost of assisted living in the US. In 1984 the Humane Society was incorporated as a not-for-profit corporation.

It is a 501c3 organization for tax purposes and donations to it are tax deductible to the extent permitted by law.

Here S Your New Standard Tax Deduction For 2022

Assisted Living Facility Executive Summary Pdf Free Download

The Tax Deductibility Of Long Term Care Insurance Premiums

You May Be Able To Deduct Some Ccrc Costs From Your Taxes Mylifesite

![]()

Home Care Home Health Or Assisted Living Leeza S Care Connection

Nursing Home Costs And Ways To Pay

How To Maximize Medical Expense Deductions Retirement Watch

How Much Does Assisted Living Cost Where You Live Matters

Can You Claim A Tax Deduction For Assisted Living The Arbors

How To Pay For Assisted Living For Your Loved Ones Lakeside Manor

Continuing Care Retirement Community Dilemma Entrance Fee Bankrate Com

How Much Does Assisted Living Cost Where You Live Matters

Taking Advantage Of The Tax Benefits Of Ccrcs Mylifesite Blog

Can You Claim A Tax Deduction For Assisted Living The Arbors

Home Care Home Health Or Assisted Living Leeza S Care Connection

Retirement Planning An Infographic How To Plan Retirement Retirement Planning